Do I need to report my saving and checking account interest ($7) if I didn't receive a 1099INT?Bill Pay (92) How do I delete an automatic payment?I don't earn interest on my accounts?

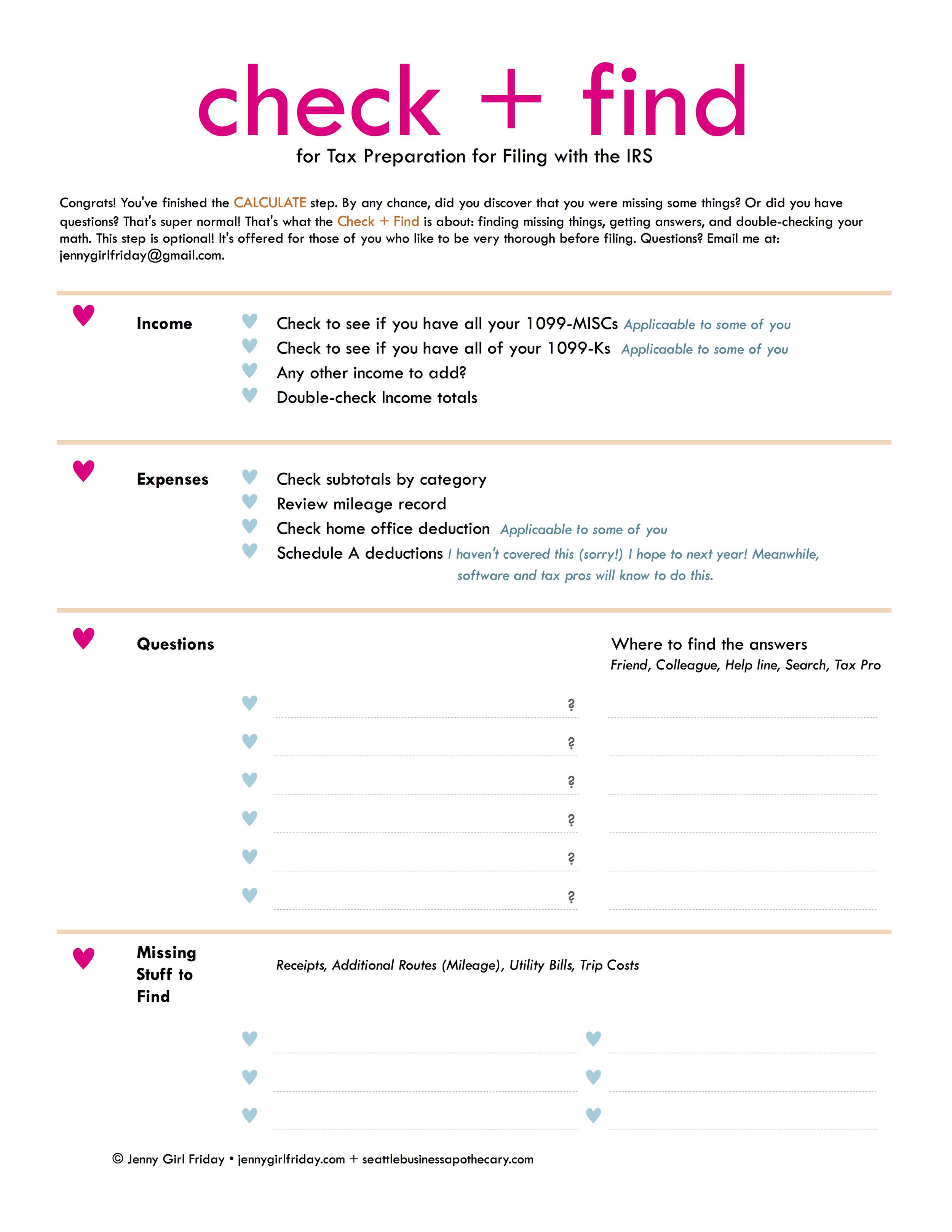

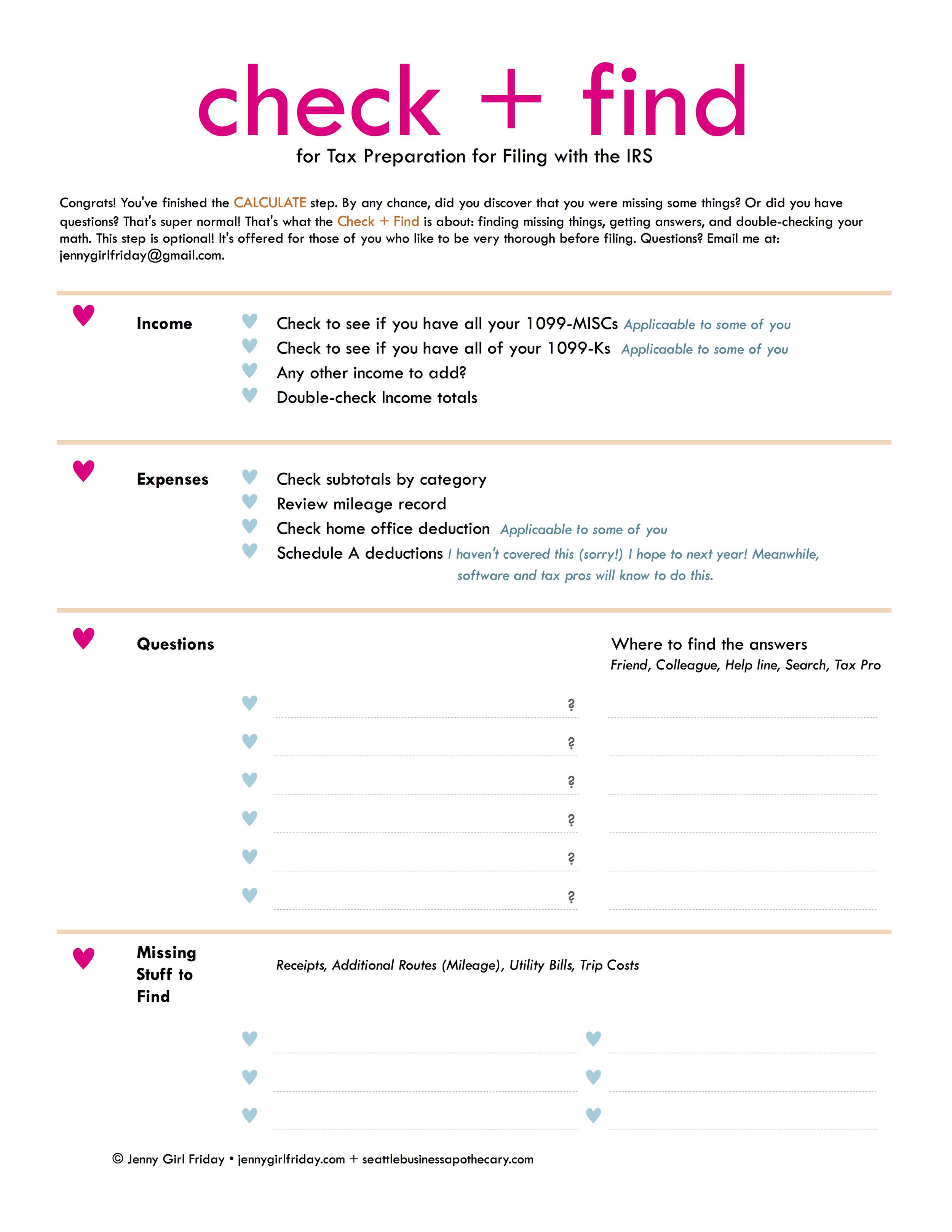

1099 Misc Irs Tax Prep Seattle Business Apothecary Resource Center For Self Employed Women

Do i need a 1099 for my checking account

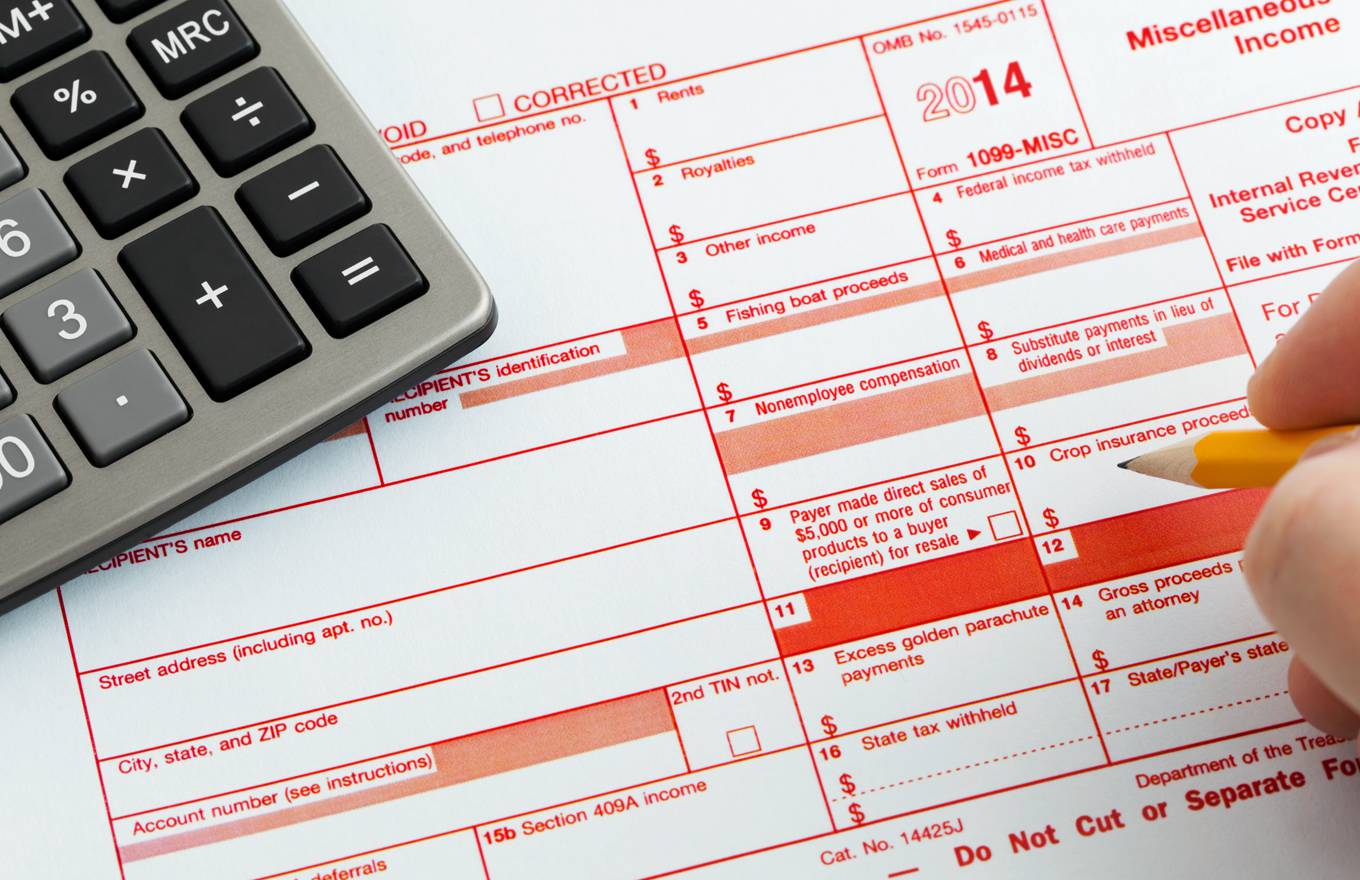

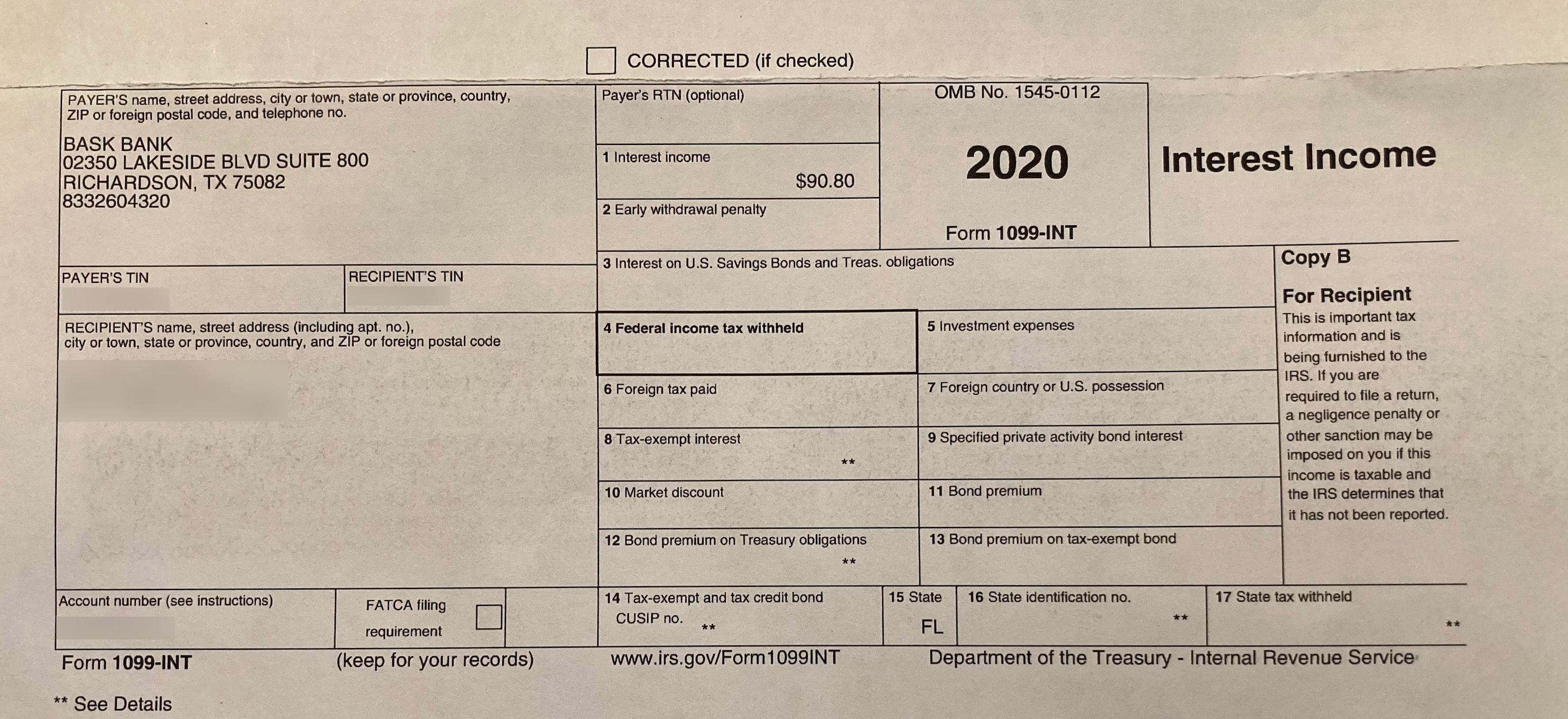

Do i need a 1099 for my checking account- Banks and other businesses are required to send you a Form 1099INT if they pay you $10 or more in interest during the year This includesSign in to access your forms A corrected Consolidated Form 1099 may be required under these circumstances A newly signed Form W9, changing the SSN or TIN reflected on the original Consolidated Form 1099, was received

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

Consolidated 1099 tax forms and supplemental information May include IRS Forms 1099DIV, 1099INT, 1099MISC, 1099B and 1099OID, depending on your situation 5498 This form reports your IRA, SEP–IRA, ROTH IRA, and SIMPLE IRA contributions Accounts will mail with Form 1099R A 1099INT is an official tax form from the Internal Revenue Service that banks and other financial institutions use to report annual income from interestbearing accounts Financial institutions are required to provide complete 1099INT forms to account holders who receive ten dollars or more in taxable interest income If you did not receive a 1099INT form from yourOpen a checking account with Citadel and enjoy convenient digital banking tools, direct deposit, overdraft protection, and much more Citadel serves Chester County, Bucks & Montgomery County, Philadelphia & Delaware County, City of Lancaster & Lancaster PA Open a Checking Account

IRS Forms 1098 or 1099, also known as "information returns," are documents that identify certain types of financial transactions to the Internal Revenue Service (IRS) Financial institutions are required to report these types of transactionsby filing these forms to qualifying individuals 2 When can I expect to receive my 1098/1099 form?Paypal Home Shopping online shouldn't cost you peace of mind Buy from millions of online stores without sharing your financial informationProbably not, which is why the bank has NOT sent you a Form 1099INT The law requires Form 1099INT for interest amounts of $10 or more

Choose the Edit menu then Update Company Information to add the state account number FATCA;No of Recommendations 1 Fools, I know several of you have exercised Citibank's very tempting $150 signup offer Well, I started preparing my taxes and began comparing tax statements against accounts I'd had this year and found thatHow do I order checks within Online Banking?

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

Taxes For Amazon Flex 1099 Delivery Drivers

A 1099R form is a type of form 1099 used for reporting distributions from a retirement or taxdeferred account, such as an IRA, 401 (k) or annuity, during the tax year 1 These 1099R forms are sent to investors by the custodian or investment company where the investments are held These may include mutual fund companies or discount brokers 2New account will not be eligible for offer if any signer has signing authority on an existing PNC Bank consumer checking account or has closed an account within the past 90 days, or has been paid a promotional premium in the past 24 months If multiple accounts are opened with the same signers, only one account will be eligible for the premium For this offer, signing authority will be definedHow do I get a User ID and Password?

1099 Int Your Guide To A Common Tax Form The Motley Fool

The Garden City News 8 30 19 By Litmor Publishing Issuu

Look for the account in the Apply payments to this 1099 box column If you're unable to see it, tick the Show 1099 accounts dropdown and change it to Show all accounts (see the image below) When you're done, click Save & Close Please check out this article for details How to modify your chart of accounts for your 1099MISC and 1099NEC filingTransfers (84) What is Zelle®?Updated A 1099 form reports certain types of income that a taxpayer has earned throughout the year A 1099 is important since it's used to

How To Read Your Brokerage 1099 Tax Form Youtube

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

What types of accounts can I use in Zelle®?How do I delete a Biller? This includes interest on checking and savings accounts If the interest amount is over $10, the bank is required to issue a Form 1099INT Even if you don't receive this form, you would still enter any interest income as if you had Interest from a checking and/or savings account would be reported in Box 1

/FilingTaxesforInterestIncome-b6ac80f8297a426eb43b44b40915c0b4.jpg)

How Interest Income Is Taxed And Reported On Your Return

Do You Need To Issue A 1099 To Your Vendors Accountingprose

What is a 1099 Vendor?However, what you probably meant is do you put the $5 on the Form 1099INT masque on the tax software?The application populates the Account number field on Form 1099 with a unique account number to ensure that any Form 1099 corrections can be correctly tracked This field cannot be overridden on the form with another account number Per IRS general instructions for certain information returnsthe account number may be a required field Accounting CS populates this field

What To Do With Form 1099 Misc

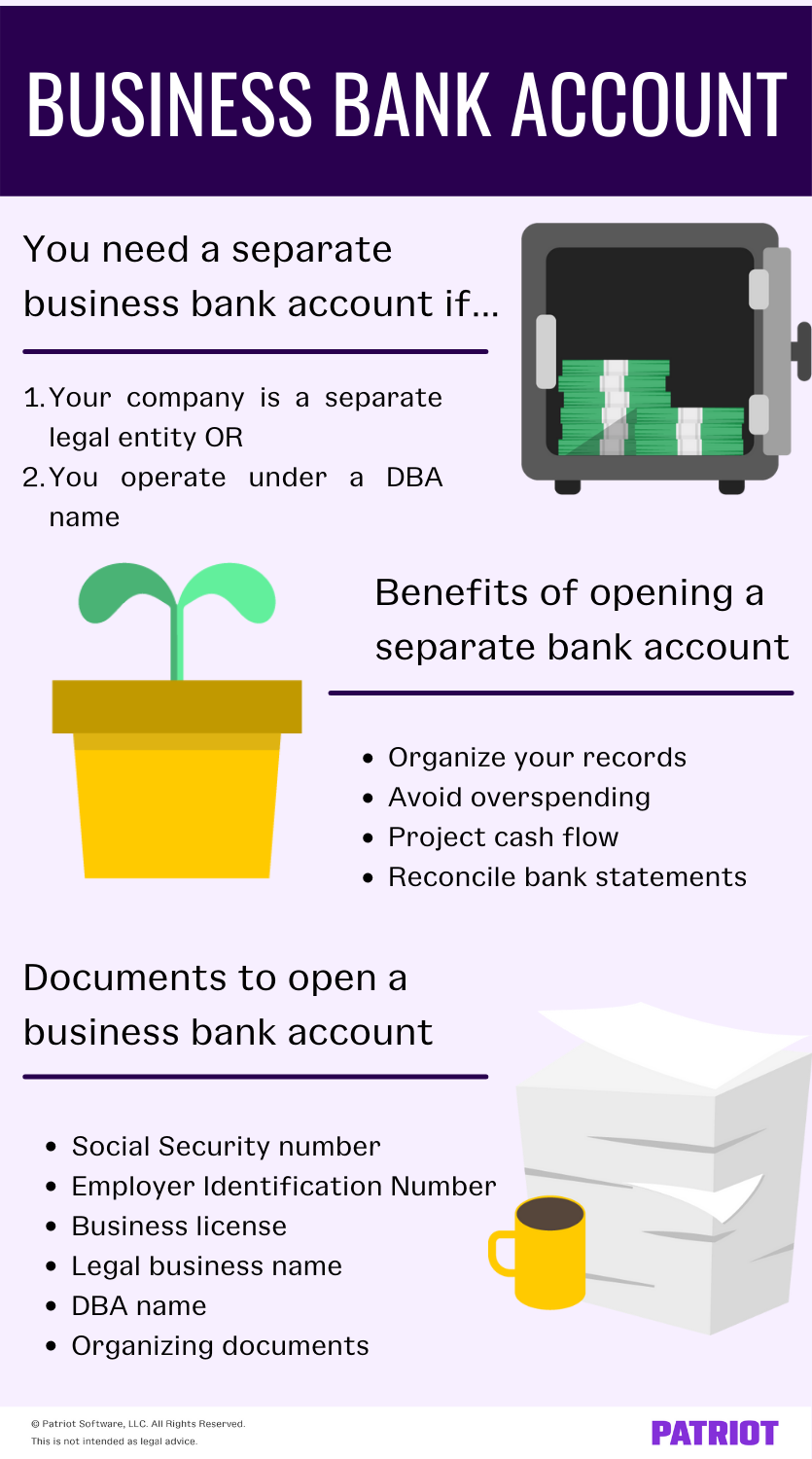

Do I Need To Open A Business Bank Account Your Business Guide

Your understanding is incorrect If the amount is under $10, then the payer is not required to send you a 1099INT, however, you are required to report all income whether you get a 1099INT or notWhy did I receive a 1099INT form?A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package If you designate a supplier as a 1099 vendor, the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar yearThe company then sends the resulting 1099

How Do I Confirm The Mapping Of Accounts To The 1099 Box 7

Aw Tax And Financial Services Photos Facebook

Online Services We are constantly expanding our online services to give you freedom and control when conducting business with Social Security Today, you can apply for retirement, disability, and Medicare benefits online, check the status of an application or appeal, request a replacement Social Security card (in most areas), print a benefit verification letter, and more – from anywhere and The 1099 box and amount can be filled in on the invoice only if the Report 1099 check box on the Tax 1099 FastTab of the vendor details page is selected Go to Accounts payable > Periodic tasks > Tax 1099 > 1099 main account association In the Main account number field, select the main account to relate to a 1099 box You can select only a main account of the Expense type In the 1099 An independent contractor is selfemployed and receives 1099 forms from each client they did work for during the year An independent contractor fills out a W9 for their client For a sole proprietor, these 1099 forms (along with all the business expenses) flow onto Schedule C and then on to the 1040

1099 Misc Irs Tax Prep Seattle Business Apothecary Resource Center For Self Employed Women

Geo Unm Edu All Handouts Tax Help Pdf

Most banks, and this is the case for banks such as Bank of America, Chase and Huntington, will issue Form 1099INT for a cash bonus when opening a checking accountIf a gift (not cash You'll typically receive a 1099INT from your bank or credit union if you hold accounts that produced interest income of $10 or more You'll also receive one if any foreign taxes were withheld and paid for from your interest income, or if your A 1099 form is a record that an entity or person other than your employer gave or paid you money The payer fills out the 1099 form and sends copies to you and the IRS There are several kinds of

1099 Oid Template That Has To Be Supplied To Us Irs Tax Forms Taxation

How To Report Foreign Earned Income On Your Us Tax Return

See fee schedule for details Free gift may be reported on a 1099INT or 1099MISC Free gift provided at the time of account opening Up to $10 for checks and debit cards from another financial institution given at the time the checks/debit cards are presented Simply Free Checking*, a free account for everyone If your checking account produced at least $10 in dividends, your credit union should provide you with a Form 1099INT rather than a Form 1099DIV You are required to report any dividends you received on your credit union share account, regardless of whether you received a Form 1099INT You must report this income as interest rather than as dividends Some money If the bank have not sent a 1099 then the risk of the IRS finding out by themselves is very slim They would however expect you to report it, and might get grumpy if they later found out by means of an audit, etc (though that's also unlikely to happen) As a student though, I would assume your marginal rate is pretty low What's the tax liability on this $30?

6 Common Reasons Your Investments May Trigger An Irs Audit Bankrate

1

With a USAA Classic Checking account or USAA Youth Spending account, you get 10 free withdrawals every month from more than 60,000 USAApreferred ATMs A reimbursement up to $15 per statement cycle in other banks' ATM fees in the United States only The refund is deposited monthly, right before your statement is sent Purpose of Form 1099INT Any year that a bank pays you more than $10 in interest, it is required to send a Form 1099INT to both you and the Internal Revenue Service That way, not only do you knowChecking Accounts Personal Savings and CDs Credit cards Mortgage Business Banking Services Investing and retirement x You're leaving Union Bank By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business By linking to the website of this private business,

Missing An Irs Form 1099 Don T Ask For It Here S Why

What Is A 1099 Form And 1099 Form Tips Freelancers Need To Know

How do I update an automatic payment?This account requires eStatements to avoid conversion to different checking product not eligible for cash back Limit one Cashback Checking account per membership account number Business accounts not eligible for this product Cannot be opened in conjunction with Premier, Interest, Investors, Loan Advantage or Cashback Free Checking Qualifications for cash back The membership account If you earned more than $10 in interest from a bank, brokerage or other financial institution, you'll receive a 1099INT The 1099INT is a common type of IRS Form 1099, which

Earn Interest In 18 Get To Know Form 1099 Int The Motley Fool

Bmonthly May 14 By Bmonthly Magazine Issuu

Classic Checking Account Our Classic Checking account requires a $250 minimum balance and earns monthly dividends, with no service charge If your balance drops below $250 on any day of the month, a fee will be charged for each check that clears your account $5 opening deposit Maintain daily balance of $250Subject Citibank Online Checking (1099INT) Date 2/5/04 653 PM Post New Post Reply Reply Later Create Poll Report Post Recommend it!We use specific forms, such as IRS Forms 1099 and 1098, to annually report income and interest paid You may have the option to set your delivery preferences for how you would like to receive your tax documents depending on the types of accounts you have To update delivery preferences for your tax documents, sign on to Wells Fargo Online ®

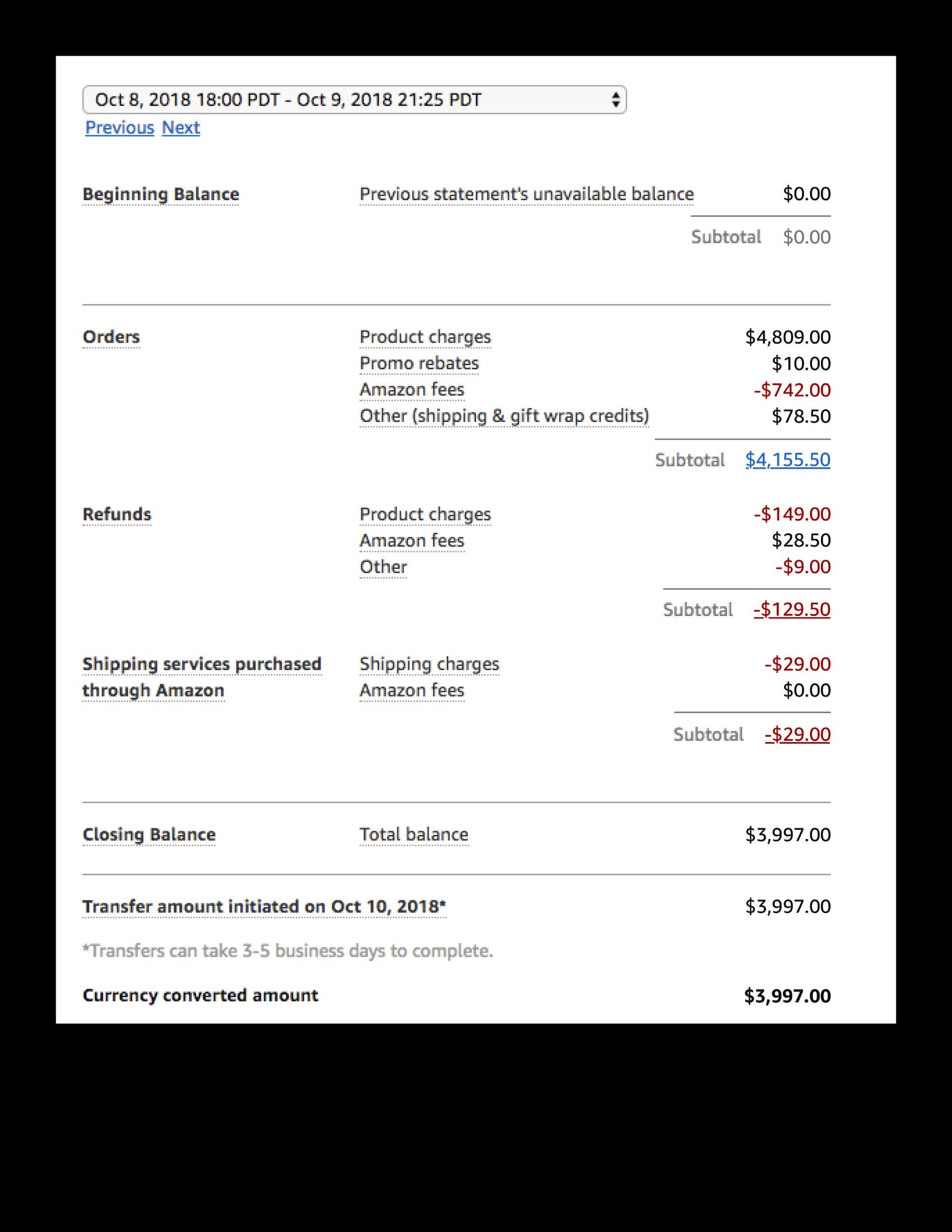

Form 1099 K And Ecommerce Merchant Fees Bench Accounting

Is Your Accountant Charging You For Unnecessary 1099 Necs Eric Nisall

If the checkbox for FATCA is selected, then an account number must be present Recipient Wage Amounts When the 1099 Preparer is verifying recipient wage amounts, there are two types of errors that can occur 1 Fatal Errors IRS has resurrected IRS Form 1099NEC and redesigned IRS Form 1099MISC Beginning tax year , all payment amounts previously reported in Box 7, Nonemployee Compensation of the 1099MISC will now be reported in Box 1, Nonemployee Compensation of the 1099NEC 2 Currently, DoD convenience check writers (account holders) obtain, complete, and submit convenience check Find out who has the pay the taxes on joint bank accounts that earn interest based on the relationship of the account owners and ownership of the account funds By Lance Cothern Updated

:max_bytes(150000):strip_icc()/ScreenShot2021-06-03at10.46.06AM-94eb26d209884e0e9190a59995dbee63.png)

What Is Irs Form 1099 C

Studentchecking Twitter Search

QB 1099 wizard says to exclude payment "edit the check number and add appropriate notation" I'm thinking this is a bug as I've never had to do this before when the items were on different checks Note Under Map vendor payment accounts the liability payment is "Omit these payments from 1099" Solved!What if I forgot both my User ID and Password?For deposit accounts (Consumer Checking, Savings, Money Market and Certificate of Deposit accounts) the following documents are available 1099INT Interest Income earned ($10 or more per year, or if tax dollars are withheld) 1099MISC Other nonemployee income ($600 or

1099 Misc Instructions And How To File Square

The 1099 Report For Contractors Is Not Showing Up For All Contractors There Are About 28 But Only 1 Shows Up In The 1099 Report It Seems Like It S A Qbs Online Error

Here's a breakdown of how reporting will work if you have multiple Capital One Bank accounts If the combined total of interest across all accounts is $10 or more, you will receive a 1099INT form for the interest paid in your Capital One 360 accounts, and a separate form for the interest paid in your non360 accountsA 1099 is another option for stating income besides the W2 The 1099 is another form that is connected to the tax return and serves as evidence that income is paid to a specific taxpayer Since the 1099 also includes the taxpayer's social security number (SSN), the IRS is able to check to see if an income has been reportedThe dollar value for any special promotion or premium is considered paid interest if the value of the premium is $10 or more For example, if you opened a TCF checking account and received a $50 bonus for qualifying criteria, that the bonus is considered paid interest I cashed a bond/coupon in 19 Will I receive

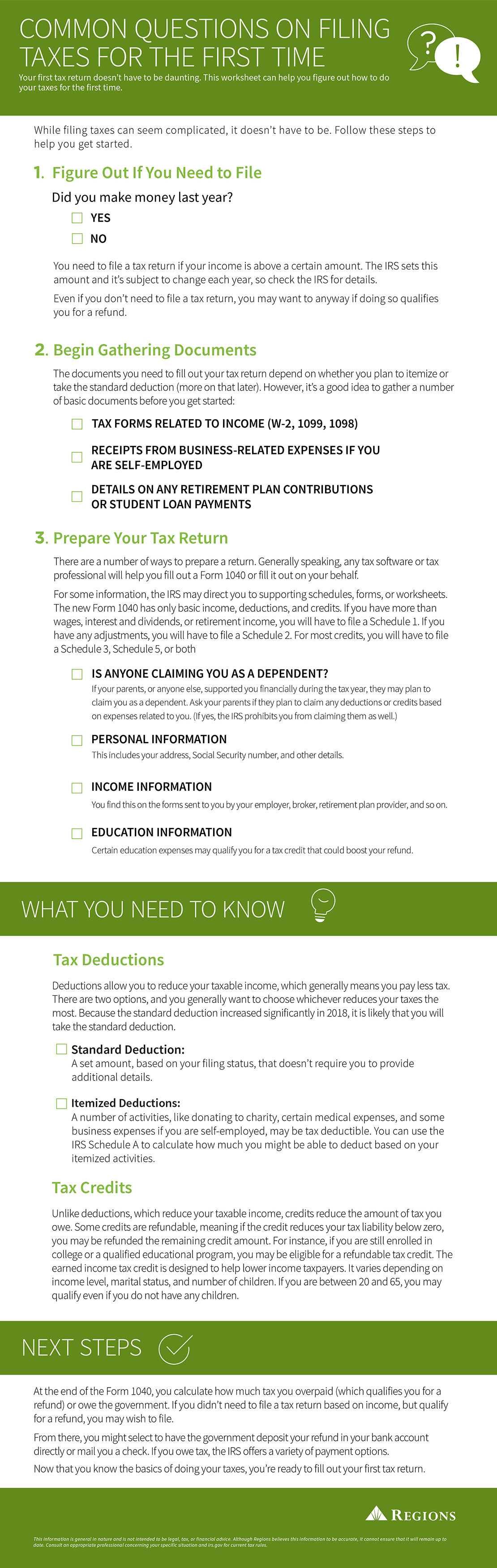

Preparing To File Your Federal Tax Return Regions

2

Transferring funds to an external account FAQs;Form 1099QA Cat No X Distributions From ABLE Accounts Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service The IRS checks the recipient's tax return to make sure he reported the income attached to his SSN Form 1099 The proper IRS form for reporting interest income earned by a joint account is Form 1099 Joint accounts present a problem for the preparer of the form, since only one person and one SSN can be shown

How To File Us Tax On Nre Nro Interest Without 1099 Int Usa

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Rates and offer dates subject to change without notice and offer may be withdrawn at any time Fees may reduce earnings on the account A minimum of $25 is required to open an account Limited to one new checking account per customer Offer is considered interest and will be reported on IRS Form 1099INT (or Form 1042S, if applicable)The recipient's bank account number (eg, their checking or savings account number) The recipient's bank's full name and address The banking system to be used – ABA Routing Number (Fed Wire Number), SWIFT or CHIPS The recipient's bank's institution number, for example ABA Routing # Please Note Fees from the financial institution you transfer funds to andThe answer is YES, you should report the $5 Will it affect the amount of tax owed?

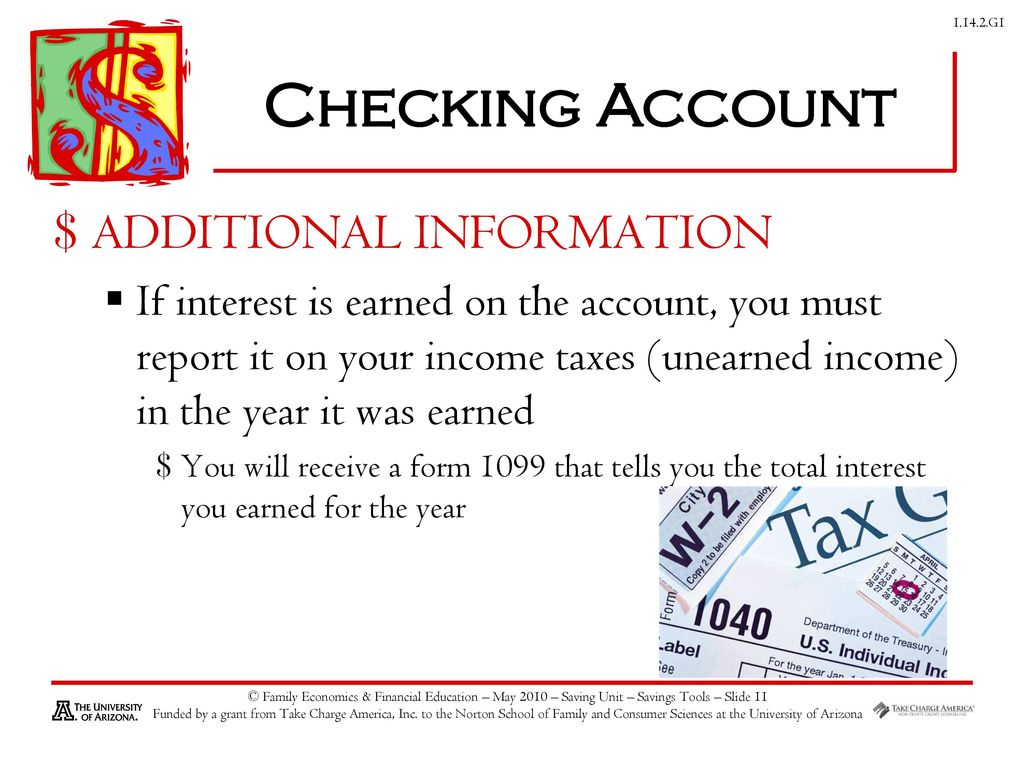

Savings Investing Ppt Download

3

Check if you need to submit 1099 forms with your state Depending on where your business is based, you may also have to file 1099 forms with the state Check in with your CPA and ensure you're compliant with your state's 1099 filing requirements How to file 1099s online Copy A You can efile Copy A of Form 1099NEC through the IRS Filing a Return Electronically (FIRE)Your bank or other financial institution will send you tax form 1099INT early in the new year for any interest earned on the account if the earnings are more than $10 However, whether or not you

Www Midlandsb Com Sites Default Files 21 05 Check250 Pdf

Stimulus Check Delays Issues Tax Return Amount Ksdk Com

2

Who Needs A 1099 Compass Consulting Services

/bank-5c7cad9446e0fb00019b8e01.jpg)

How Is A Savings Account Taxed

Paypal Sellers Understanding Your 1099 K Kabbage Resource Center Kabbage Resource Center

6 Types Of 1099 Forms You Should Know About The Motley Fool

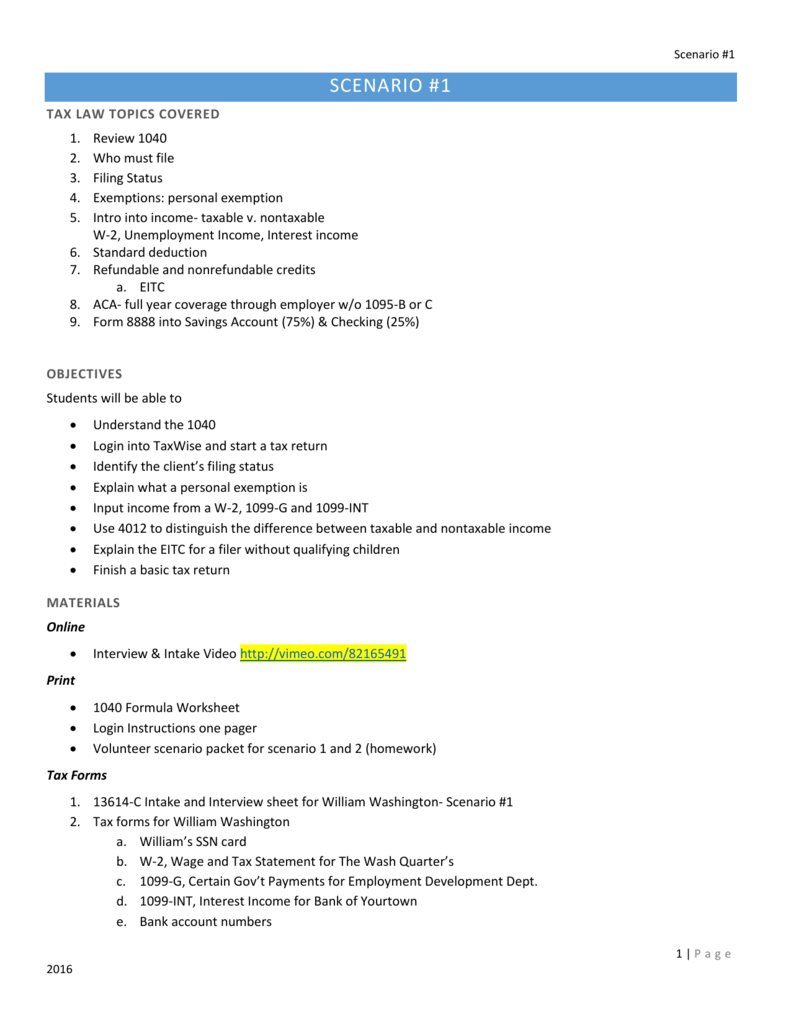

Instructor Lesson Plan Scenario 1

Solved All Of My Vendors Who Are 1099 Eligible Are Not Showing Up On 1099 Summary

3

Has Anyone Received A 1099 Int From Capital One For The 400 Checking Account Promo Churning

Common Questions On Filing Taxes For The First Time Regions

When Will I Have All My Tax Documents The Motley Fool

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

How Much Should You Budget For Taxes As A Freelancer

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Should Church Send Guest Speaker A 1099 Form

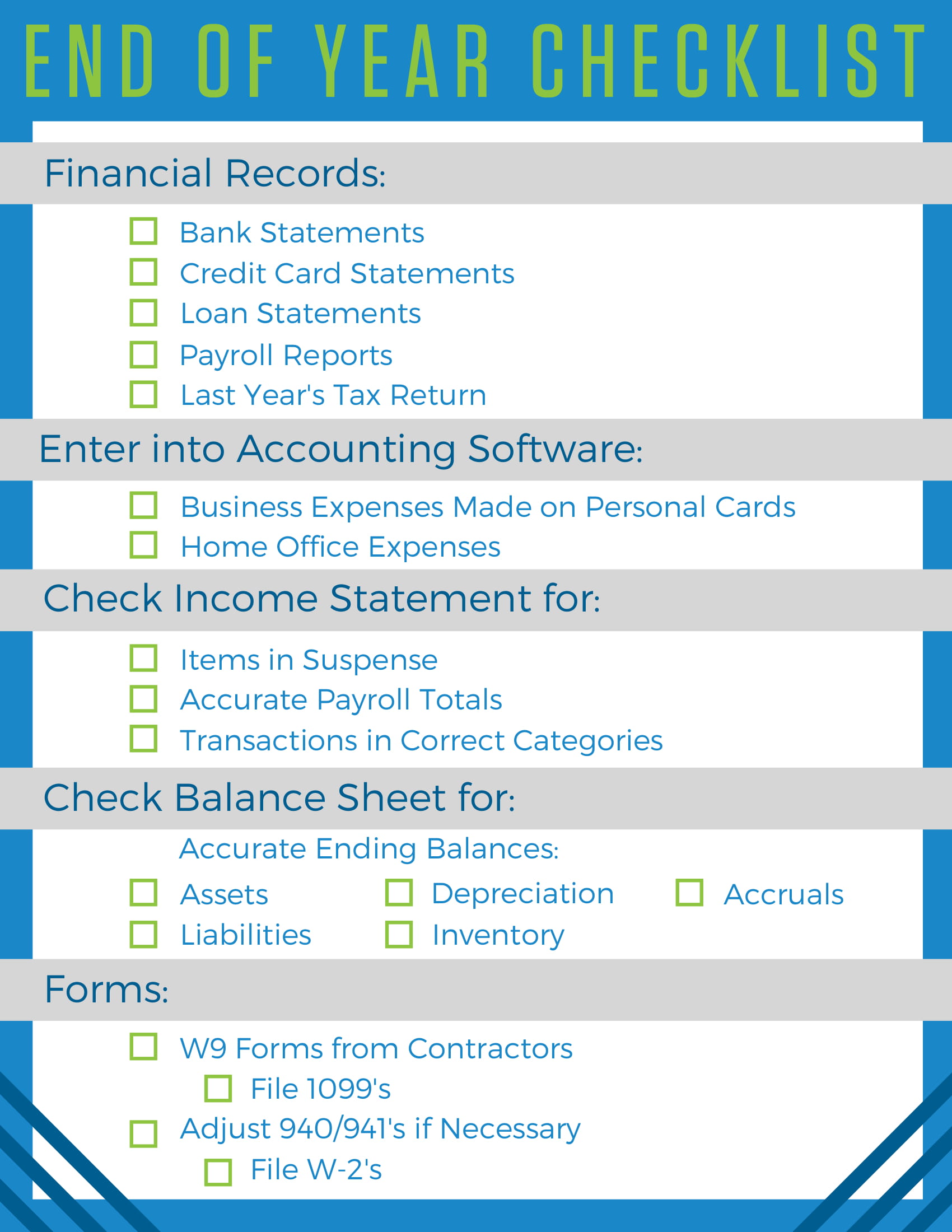

An End Of Year Checklist For Small Business Owners

Olui2 Fs Ml Com Publish Content Application Pdf Gwmol Guidetoyourtaxreportingstatement Pdf

2

How To Update Bank Account Number With The Irs Irs Zrivo

Should I Open A New Bank Account For A Cash Bonus

What Is Form 1099 Int How It Works And What To Do Nerdwallet

Chase Is Sending New 1099s To Cardholders Reporting Referral Income To The Irs

Acorns 1099 Taxes Everything You Need To Know

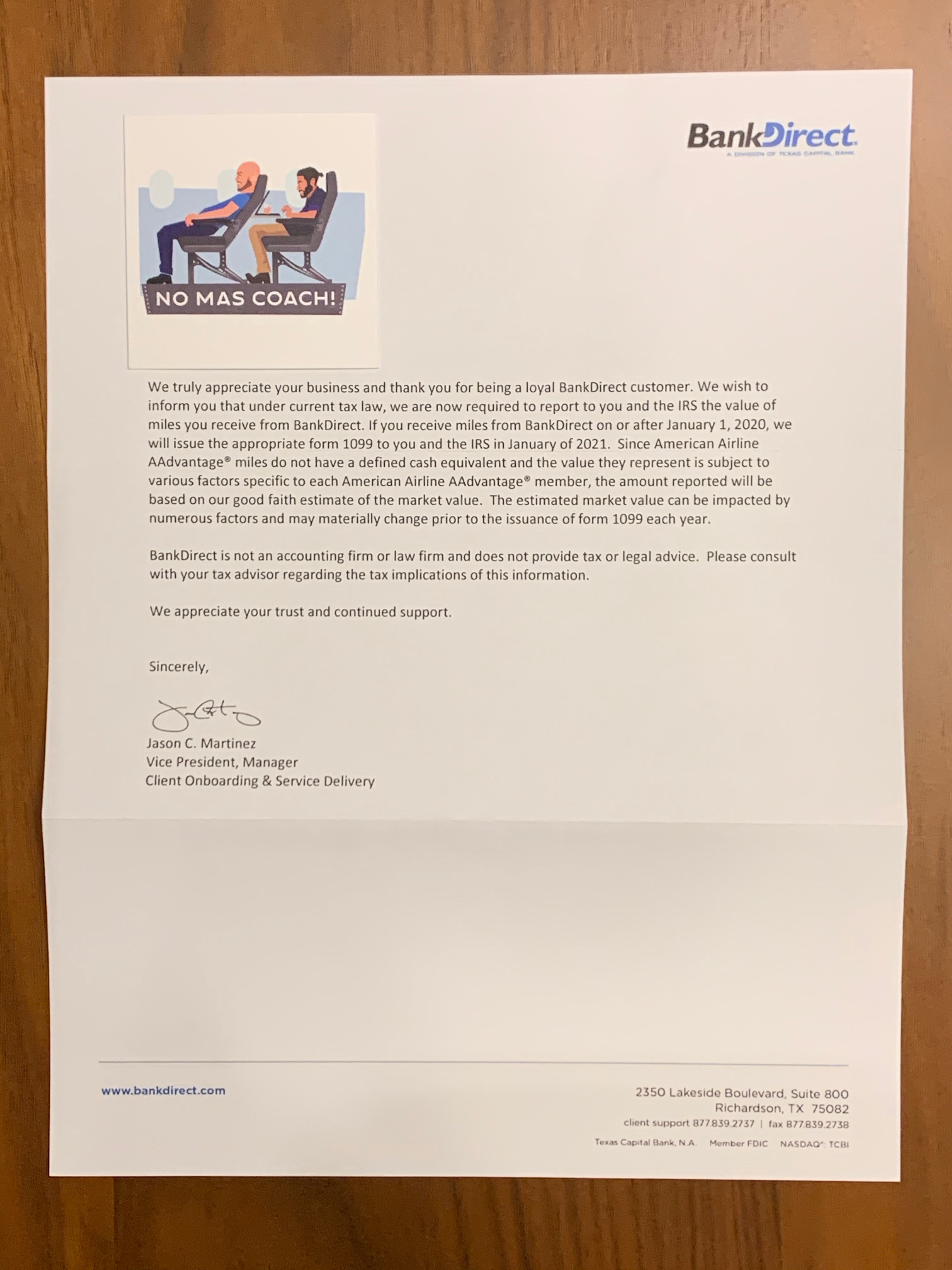

Bask Bank Sending Out 1099 Forms And They Re Not Bad No Mas Coach

Complete Guide To Paying Taxes On Credit Card Rewards

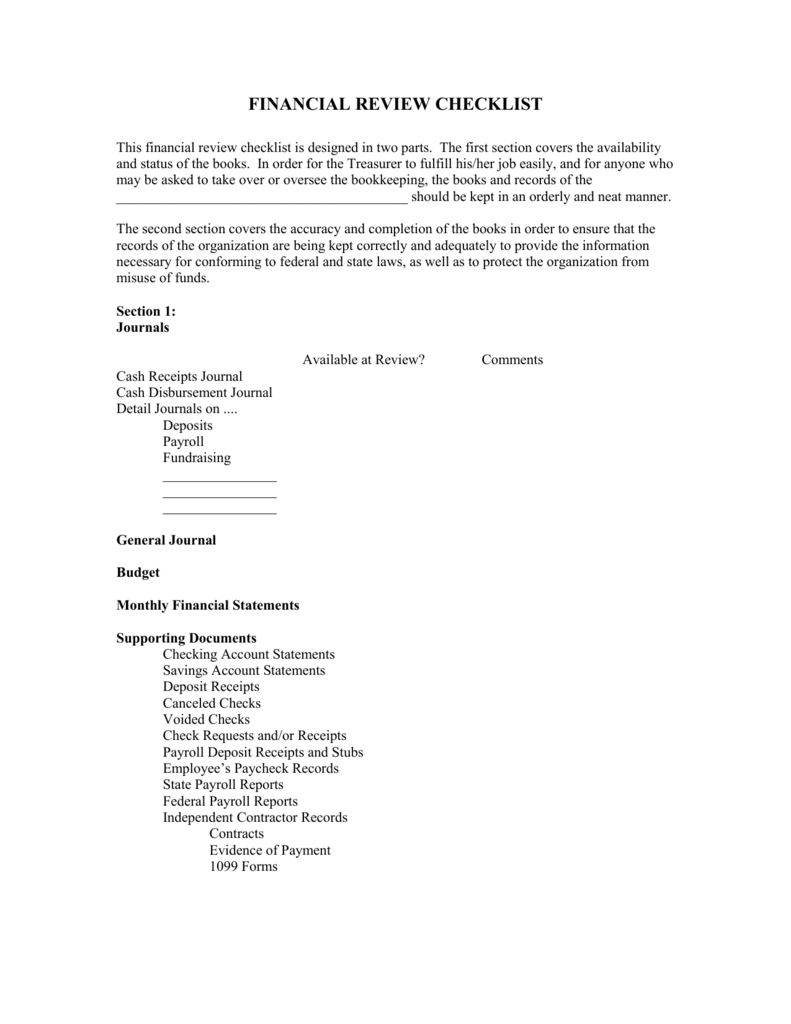

Financial Review Checklist For Internal Audits

Everything You Need To Know About Bankamerideals Forbes Advisor

When Juicy Rewards For Opening Bank Accounts And Credit Cards Are Taxable

Form 1099 Div Dividends Distributions Nerdwallet

2

Http Www Unitedwayncfl Org Sites Unitedwayncfl Org Files Vita checklist 18 Pdf

Olui2 Fs Ml Com Publish Content Application Pdf Gwmol Guidetoyourtaxreportingstatement Pdf

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

How To Deal With An Incorrect 1099 Form Helpful Example Pt Money

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

2

Why I Transitioned From 1099 To S Corp And How It Impacted My Freelancing Business Articles Matt Olpinski Ui Ux Designer For Web Mobile New York

Financial And Tax Records Dealing With Clutter

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

Irs Tax Form 1099 Misc Instructions For Small Businesses Contractors

Solved How To Prepare 1099 Miscs For Independent Contractors In Quickbooks Online Plus

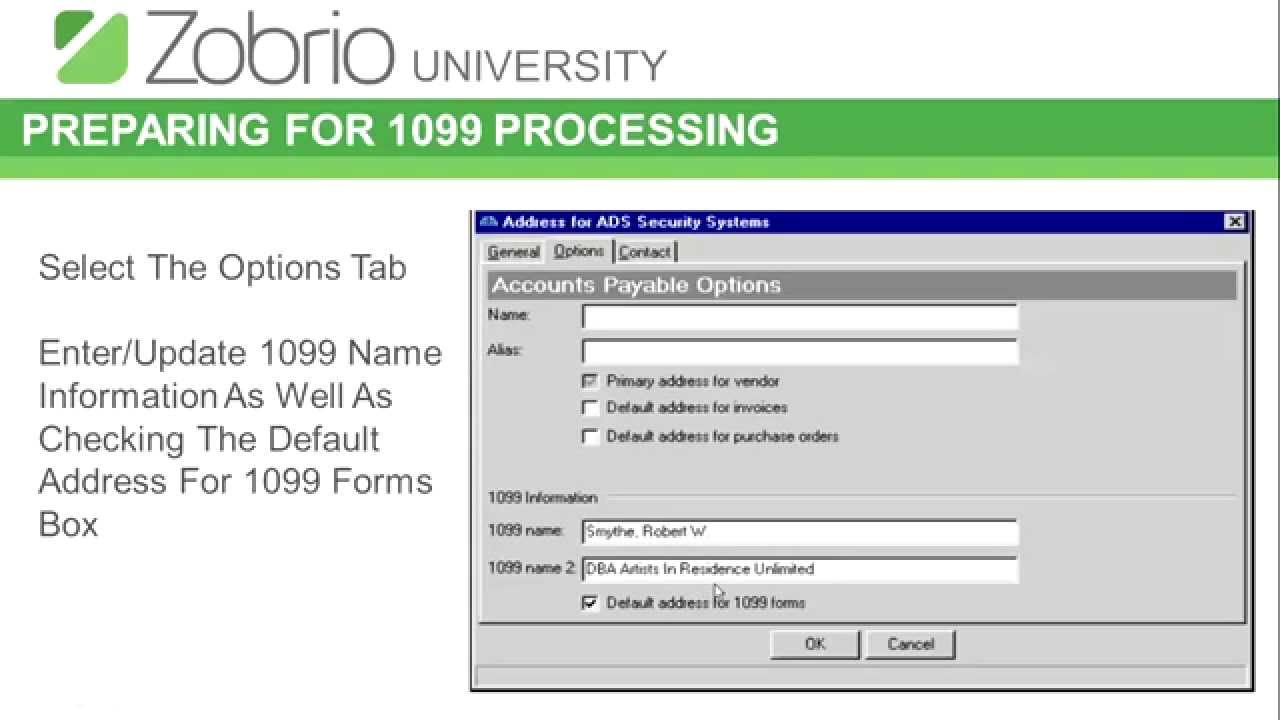

Preparing For 1099 Processing With Financial Edge Youtube

How Do I Adjust A 1099 Misc Income Figure

Report Interest Income To Irs Even If It S Just 50 Cents

Healthaccounts Bankofamerica Com Assets Pdf Hsa User Guide Pdf

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

Best Tax Filing Software 21 Reviews By Wirecutter

2

Form 1099 Int What To Know Credit Karma Tax

2

2

Fifth Third Customer Gets 250 For Opening An Account Then Receives Tax Form In The Mail Money Matters Cleveland Com

Form 1099 Nec Your Handmade Business The Yarny Bookkeeper

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Gateway Bank Fsb Posts Facebook

Sample Subpoena Language Pdf Free Download

What To Do About Fraudulent Unemployment Benefits On 1099 G

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

What If I Didn T Receive A 1099 The Motley Fool

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

2

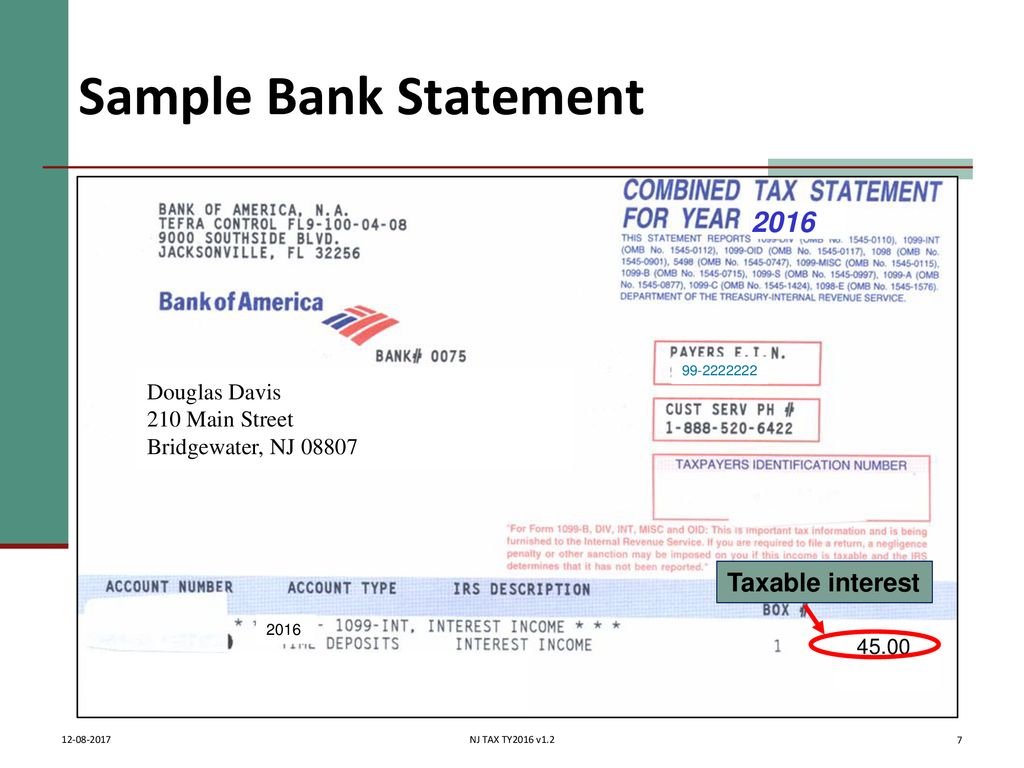

Interest Dividends Pub 17 Chapters 7 8 Pub 4012 Tab D Ppt Download

Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

How Taxes Work On High Yield Savings Account Interest

Chase 1099 Reporting Thread Churning

What Is The 1099 Nec For Contractors And Freelancers

What Are Information Returns Irs 1099 Tax Form Types Variants

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

How To Reconcile In Quickbooks The Complete Guide

0 件のコメント:

コメントを投稿